Today’s #TipTuesday is a continuation of what happens during Retirement transactions in Dynamics GP. Today: different retirement types and the impact on which Gain/Loss account is chosen.

The previous posts so far are:

- Additions with & without YTD/LTD amortization

- Depreciation/Amortization

- Retirements in the 1st year of ownership

- Retirements after the 1st year of ownership

Setting the stage

In this post, I’m using a slightly different asset to make things simpler for me in terms of configuration! I have an asset – DESK011 – which is an asset card for 10 desks. They still individually have a value of $1,200 cost. The settings are identical to the settings for the other desks in the last 2 weeks of posts.

Here is what the asset looked like before I began my retirement. This is showing the value of 1 of the 10, even though the actual card values are 10x this amount, i.e. the asset card is $12,000, not $1,200, and the Qty value is 10.

Scenarios

This one is similar to the previous two weeks of posts about retirement transactions in that the entries from retirement were nearly identical in each case. My methodology with this set was as follows since I had 1 asset card representing 10 actual assets:

- I retired 1 at a time using the Cost of $1,200 as the basis for retirement. Side note: when I used Qty = 1 for retirement, there was some odd rounding and the cost amount wasn’t always $1,200 for some reason.

- I chose 1 different Retirement Type each time, through all 8 types.

- Only one retirement type resulted in a different GL entry: Like-Kind Exchange. That Retirement Type uses Unrecognized Gain/Loss not Gain/Loss.

A note about partial retirements

One other thing: a partial retirement will result in effectively splitting the asset into 2 cards and creating a new card for what will be retired.

For example: my asset was DESK011-1 (Suffix 1). This is more-or-less what it does (and I only say more or less because I don’t have access to the actual code).

- FA creates a new asset for the part that will be retired. In my case, for the first retirement, it created a DESK011-2 card for $1,200.

- It proportioned out the values such as a portion of amortization YTD and LTD, and reduced the value of the original asset, DESK011-1, appropriately.

- It then retired DESK011-2.

A single asset cannot have a mixed status, therefore the result is 1 asset card that is still active and 1 asset card that is retired. Here’s what mine looked like after this was done. The only reason mine jumped from 1 to 9 in suffix values is that my first attempt to retire was using Qty not Cost as the base. I ran “retirement undo” on those and re-did it with the cost for this post, thus it continued the sequence where it left off.

Results

The results were nearly identical with each, apart from the Like-Kind Exchange type. I say nearly identical because there were odd rounding of the other amounts in the journal entries even though I retired $1,200 of cost each time. I chalk this up to my using parts of 1 card each time I retired the asset, so in creating a partial asset, some odd math may have occurred when it calculated things. This screenshot shows “Abandonment” but the results were virtually identically for each.

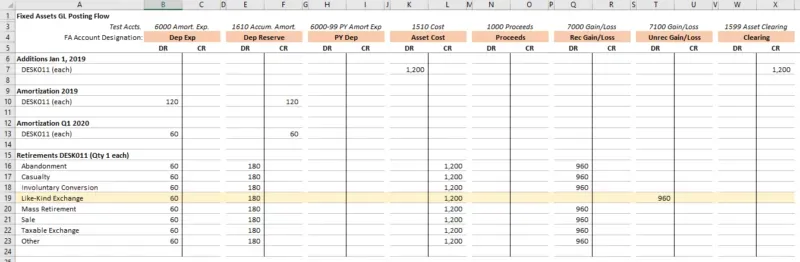

The GL results were as follows (ignoring some minor rounding issues):

- DR Depreciation Expense (000-6000-00) for $60

- DR Depreciation Reserve (aka Accum. Amort.) (000-1610-00) for $180

- DR Recognized Gain/Loss (000-7000-00) for $960 **

- CR Asset Cost (000-1510-00) for $1,200

** For the Like-Kind Exchange Retirement Type, the Gain/Loss used the Unrecognized Gain/Loss account which for me is 000-7100-00. It was still $960.

Here is the final spreadsheet: