Today’s #TipTuesday is a continuation of my Fixed Assets series around GL posting flow. This post will be the start of what happens during Retirement transactions in Dynamics GP. There are a lot of options around retirement transactions, although, in the end, most selections don’t impact the results much. I will be breaking this into different posts to keep the length manageable. Today: retirements in the first year of ownership (acquisition year).

The previous posts so far are:

Setting the stage

For this part of the series, I have created a completely new set of assets, in a Furniture class. This class has a 5-year useful life, straight-line, half-year rule. Each asset I created is a desk with a $1,200 value. The Cost and AA accounts are new, 000-1510-00 and 000-1610-00 respectively.

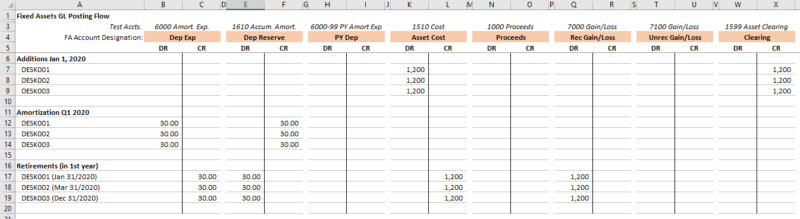

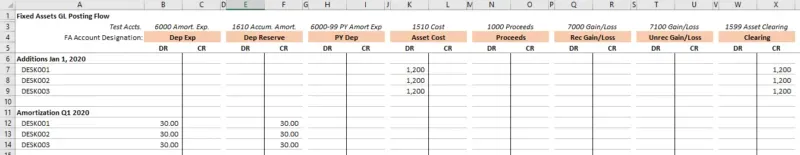

This set of assets, 3 different desks, were all purchased on Jan 1, 2020, and for the sake of my examples, I have run amortization for Q1 already (up to March 31, 2020). Here is my posting flow spreadsheet before doing any retirements. Due to the half-year rule, the amortization on the desks is $10/month so $30 each for Q1.

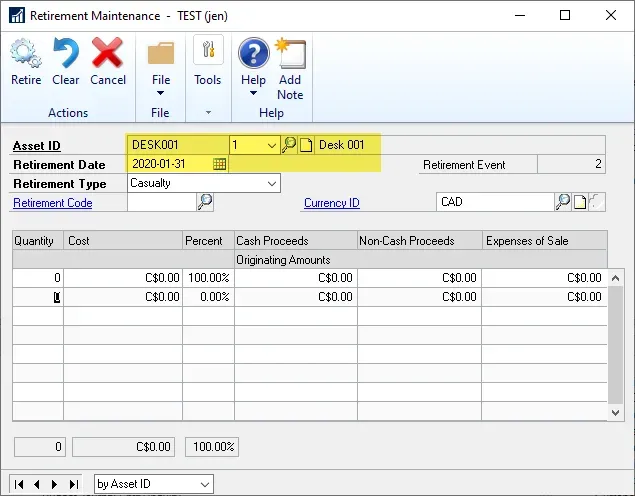

Scenario #1 – DESK001 retirement

In this scenario, I’ve chosen to retire DESK001 on Jan 31, 2020, before the last amortized date. This is an odd example I admit, but let’s assume amortization was processed before someone got the paperwork that one of the new desks was damaged in January. Hey, it happens! 😄

Here’s the retirement window showing the dates. For all of these retirements, I’m choosing Casualty as the only Retirement Type that makes a difference in the GL accounts chosen is Like-Kind Exchange (and there will be more on this in Part 5 of the series, in a couple of weeks).

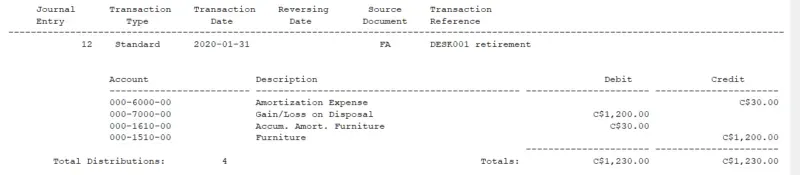

The result of that retirement is as follows:

- DR Depreciation Reserve aka Accum. Amort. (000-1610-00) for $30

- CR Depreciation Expense (000-6000-00) for $30

- DR Recognized Gain/Loss (000-7000-00) for $1,200

- CR Asset Cost (000-1510-00) for $1,200

What’s odd about this, which I can’t explain, is why it’s backing out all of the YTD amortization. I was expecting more amortization, not less. I assumed it should still claim the half-year rule on disposal.

Scenario #2 – DESK002 retirement

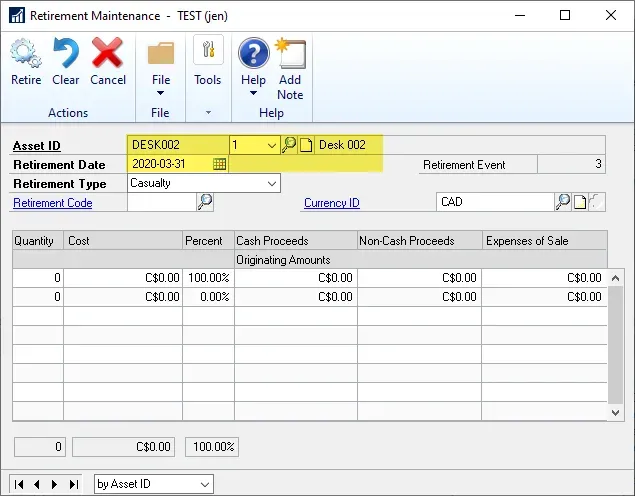

Same example, with a different date. Using March 31, 2020, as my date for this asset’s retirement, here is the retirement window:

The results were the same as for DESK001. It backed out $30 of amortization and the Gain/Loss account amount was $1,200.

Scenario #3 – DESK003 retirement

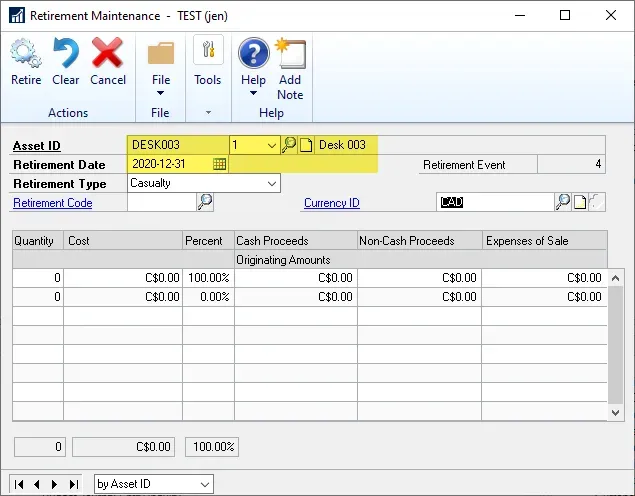

The last example, using Dec 31, 2020, as my retirement date.

The results are the same as DESK001 and DESK002. In this example, I did not run amortization up to Dec 31, 2020, before retirement. The impact I believe would be the same, it would reverse the entire year of amortization.

Summary

Perhaps I’m forgetting some of my accounting nuances this far after getting my accounting designation but this doesn’t seem right to me. I do believe this scenario (buying an asset and disposing of it in the same year) is fairly unlikely in most normal circumstances. I suppose for assets like vehicles, this can and does occur but it likely isn’t common. The impact on the P&L doesn’t change, but the GL accounts it hits might, if some of the loss should have hit Amortization Expense.

What I was expecting to occur was a half-year rule of amortization expense calculated (either added to the retirement or backed out if more amortization had occurred already).

In any event, with this sample data, the entries for all 3 retirements were identical, no matter what date I chose for the transaction. Here is the final spreadsheet showing the entries for each asset: