Today's #TipTuesday is a continuation of what happens during Retirement transactions in Dynamics GP. Today: retirements after the first year of ownership (in a year after the acquisition year).

The previous posts so far are:

- Additions with & without YTD/LTD amortization

- Depreciation/Amortization

- Retirements in the 1st year of ownership

Setting the stage

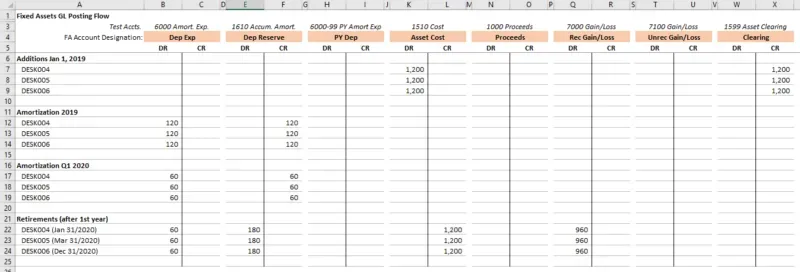

In this post, once again I have 3 new desk "assets", with the same settings as what I used in the previous example (half-year rule, straight line, 5-year life). For this example though, they were all purchased Jan 1, 2019, and thus are more than 1 year old in my examples. Here is the posting flow spreadsheet of where I am starting from, which is to say: 2019 amortization is complete as is Q1 2020.

Scenarios

Once again, the results of the scenarios were identical (to each other, not identical to the last post's results) so instead of spelling each one out and taking more pics of the retirement window, I'll just say this:

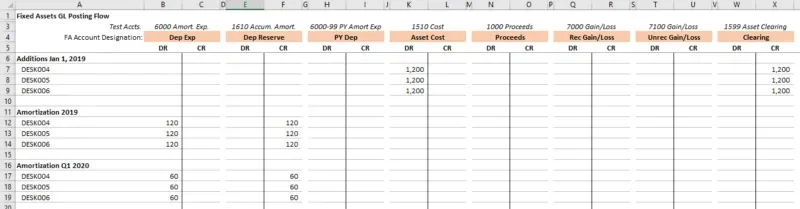

- DESK004 was retired on Jan 31, 2020 (even though amortization was up to March)

- DESK005 was retired on Mar 31, 2020

- DESK006 was retired on Dec 31, 2020 (without full-year amortization)

The result of that retirement is as follows, for each desk:

- DR Depreciation Expense (000-6000-00) for $60

- DR Depreciation Reserve (aka Accum. Amort.) (000-1610-00) for $180

- DR Recognized Gain/Loss (000-7000-00) for $960

- CR Asset Cost (000-1510-00) for $1,200

This is exactly what I was expecting in the scenarios I wrote about last week: Dynamics GP would be calculating a half-year of amortization expense and incorporating that into the retirement entry. In all 3 cases above, they had been amortized for 1 quarter, and thus 1 more quarter of amortization for the year is appropriate in the year of disposal, hence the $60 extra amortization expense. With $120 in amortization expense, that is exactly half of the annual expected amount if the asset were not retired in 2020.

Summary

This set of examples was more in line with what I expected to occur when I performed these retirement transactions. Here is my final spreadsheet for assets DESK004 through DESK006.