I'm starting a new series of posts which are going to be focused on the Fixed Assets module in Dynamics GP. I'll state upfront I don't know how long the series will last, nor how frequently I'll be writing. I am pulling out notes from 3 or 4 years ago when I first noodled this topic, reviewing what I documented at that time and setting up scenarios in my Dynamics GP environment to test and get screenshots for. It may take me a few months to work through the various scenarios and write, so be patient with me!

Today's post is about part of the General Ledger (GL) posting flow, this will be spread out into bite-sized posts reviewing various posting scenarios in Fixed Assets and reviewing the accounting entries that go with it, tying back to the Account Setup.

Background

There are a few modules in Dynamics GP where there are setup windows requiring the configuration of various accounts for this or that - Fixed Assets, Multicurrency, and Project Accounting are all modules that come to mind. As an accountant & consultant, I always was interested in seeing where the accounts get used, if it wasn't obvious by the description on the setup window.

Methodology

For the most part, I expect to follow a repeatable routine and follow some of the same assets through an abbreviated lifecycle, to review where the accounting comes from in each situation.

Roughly, that will look like this:

- Set up 1 or more Asset Cards in my test company

- Run through a scenario (addition, amortization, retirement, etc.)

- Post to the General Ledger

- Review the accounting entries

Chart of Accounts

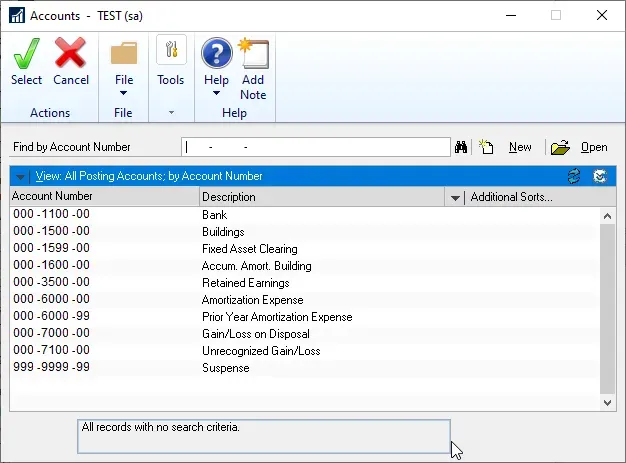

I'm not using Fabrikam for this as it has a lot of pre-configured data I don't want to have to work around to set up my scenarios. I've set up a very "vanilla" (read: plain) Dynamics GP company, using Canadian dollars as the default (of course!), and configured very little so far. In fact, in starting this I've only created only the bare minimum of GL Accounts to proceed with this testing and I haven't even configured A/R and A/P yet! I know I'll be adding more accounts but for now, I've set up 1 GL Account for each configuration line of the Account Setup window in Fixed Assets, for a class I'll start with called Buildings plus a couple of others required for General Ledger setup.

Note: I would not normally have a "prior year amortization expense" GL Account but when testing things like this, I like to configure independent GL Accounts for each specific setup/purpose so that it's crystal clear where the data is coming from. With a larger module like Project Accounting, I do the same thing and even give them names that match the setup window terms to trace activity through until I understand it.

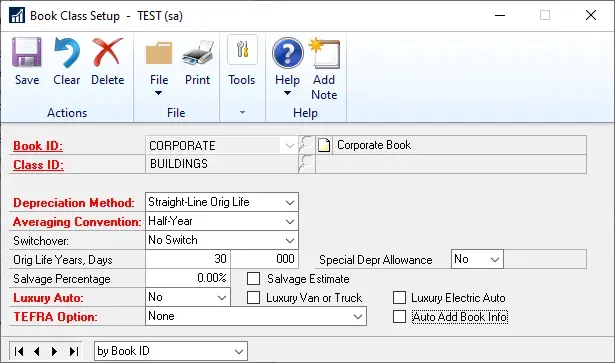

Fixed Asset Class for Buildings

My initial test data will be using a class of assets "Buildings" - and this class is set up in the Book-Class setup with a 30-year useful life, half-year rule, and straight-line depreciation. I figure the "straight line, half-year rule" is pretty standard so I plan to use that for most of my testing.

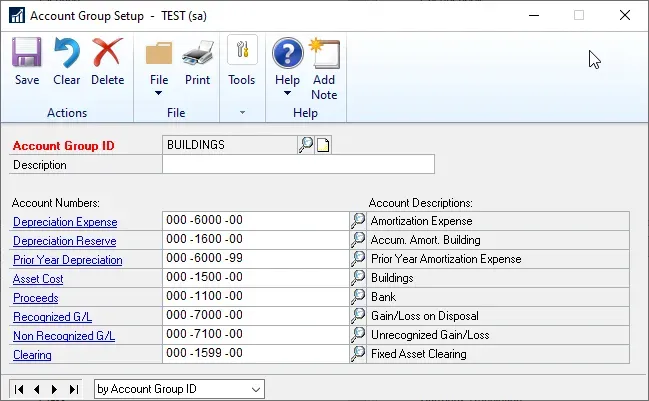

Account Setup

Here is what my account setup looks like, which is going to flow through my testing from here on out. As I mentioned above, normally the "Prior Year Depreciation" account would be the same GL Account as "Depreciation Expense"; however for this test, I want it to be unique so it is more obvious what hits "prior year" and what does not. Those 2 accounts are distinguished by a sub-account -00 vs. -99.

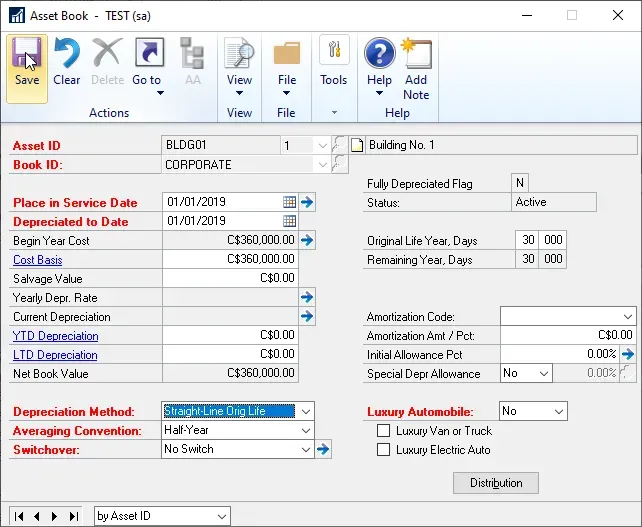

Scenario #1 - new asset addition

The first asset I've added represents the most basic of scenarios: adding a new asset in the current fiscal year. I'm ignoring the accounting behind the actual purchase, and assuming that there was a transaction that occurred purchasing a building for $360,000 and there was a debit to the "Fixed Assets Clearing" account. From that point on, Fixed Assets takes over the accounting and that's where my posts will begin.

To keep things simple, my acquisition date is 01/01/2019 although the date won't affect the accounting here.

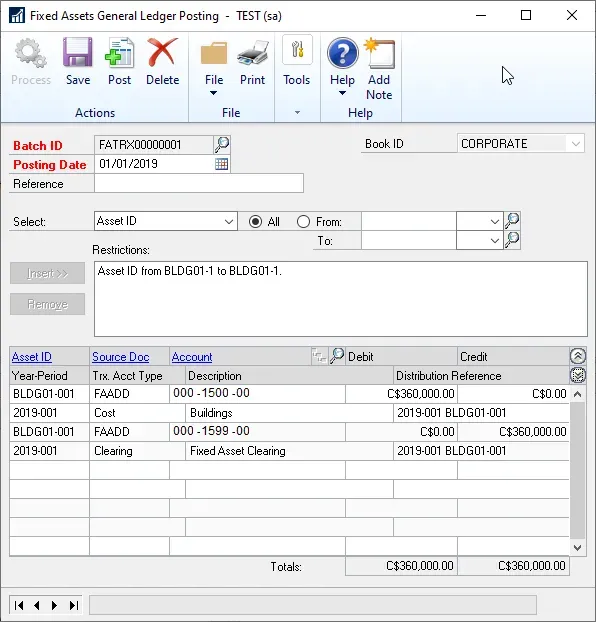

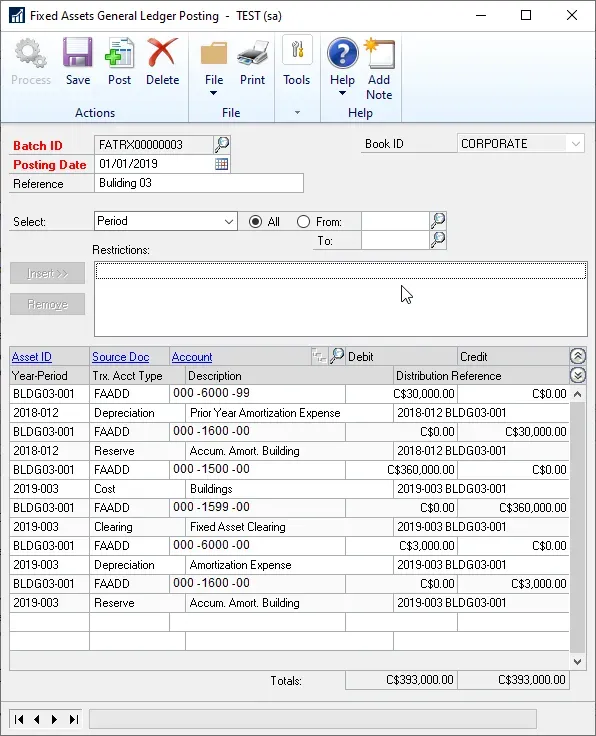

Scenario #1 - GL Posting results

The result of this addition is fairly straight-forward:

- DR $360,000 to the Asset Cost account (000-1500-00 in my case)

- CR $360,000 to the Clearing account (000-1599-00)

If the original purchase was a debit to my "Fixed Assets clearing" account, the balance would now be zero, having cleared itself out as expected. The actual purchase might have been something like DR Fixed Assets Clearing and CR Accounts Payable and ultimately Cash (or some other form of settlement).

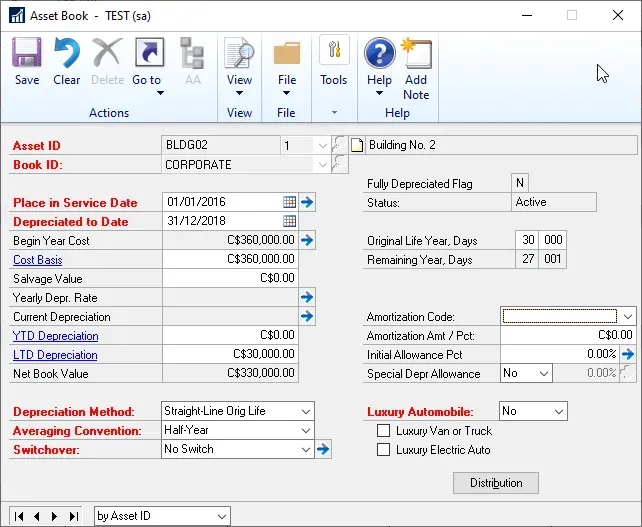

Scenario #2 - Additions from data conversion (existing assets)

The second asset I'm adding is also a building, using the same dollar amounts so it's easy to compare the entries side by side. Here I'm pretending this asset was purchased in a prior year, amortized in a prior system, and carried forward to Dynamics GP to this year as if it was a data conversion situation.

In my simple example, the building was purchased 3 years ago, on 01/01/2016 and was amortized up to the end of last fiscal year, at which point we converted it to Dynamics GP Fixed Assets. The amortization calculation would have been something like this:

- Fiscal 2016 - half year rule $6,000

- Fiscal 2017 - full year $12,000

- Fiscal 2018 - full year $12,000

So, after 3 years the LTD amortization would be $30,000. In this example, I am adding is as of the start of 2019 so "YTD" amortization is $0.

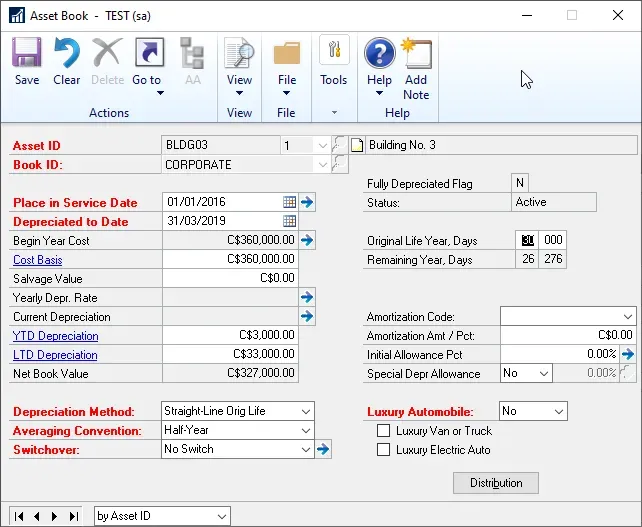

Scenario #2 - GL Posting results

The result of this addition is slightly different from scenario #1 to account for the fact that this is not a brand-new asset. Since I indicated in the booking window that LTD Depreciation was $30,000 with no current year ("YTD") depreciation amount, this is what Fixed Assets then used for posting:

- DR $360,000 to the Asset Cost account (000-1500-00)

- CR $360,000 to the Clearing account (000-1599-00)

- DR $30,000 to the Prior Year Depreciation account (000-6000-99)

- CR $30,000 to the Depreciation Reserve account (000-1600-00)

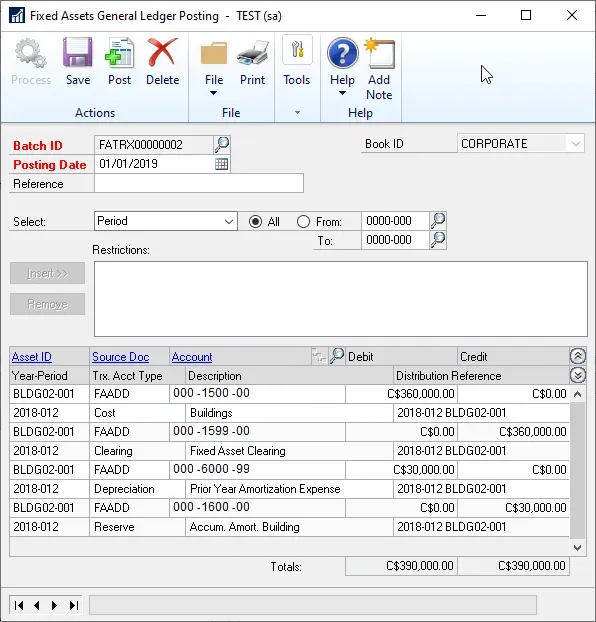

Scenario #3 - data conversion with YTD & LTD

Just for fun, here's a slight variation on scenario #2 - one more building, BLDG03 - and instead of converting it as of the end of last year, I'm mocking up a scenario where the conversion occurred after Q1 of this year, to show what happens when there is YTD amortization.

Just like in scenario #2, the building is $360,000 cost and was purchased on 01/01/2016. In this case, I've assumed it's been amortized in another system up until March 31, 2019, so I have $3,000 of YTD amortization on top of the $30,000 for 2016-2018. LTD Depreciation is then $33,000.

Scenario #3 - GL Posting results

Here are the results for scenario #3. Now there is a split of the $33,000 LTD Depreciation amount between the $3,000 which is YTD (going to "Depreciation Expense") and the rest which is going to "Prior Year Depreciation Expense").

- DR $360,000 to the Asset Cost account (000-1500-00)

- CR $360,000 to the Clearing account (000-1599-00)

- DR $30,000 to the Prior Year Depreciation account (000-6000-99)

- DR $3,000 to the Depreciation Expense account (000-6000-00)

- CR $33,000 to the Depreciation Reserve account (000-1600-00)

- This was a credit of $3,000 and $30,000 on two separate lines

Dealing with data conversion

While this next bit isn't part of the intended reason for the post, the natural question that will arise is whether entries like the last two above would theoretically duplicate GL balances where a GL data conversion will also take place. If this were a real conversion, then there would be some kind of opening balance journal entry that may already have these 2 prior year buildings on the balance sheet (and income statements/retained earnings).

What I do in Fixed Assets conversion scenarios is balance the GL Accounts with a reconciliation that uses the data from the GL Posting Journal from Fixed Assets. However, I will post the FA to the GL not through the GL so that I can print the General Ledger Edit List and file it with the reconciliation but not post it to the GL itself. There are various ways to handle data conversion, this is just one of the options I tend to use.

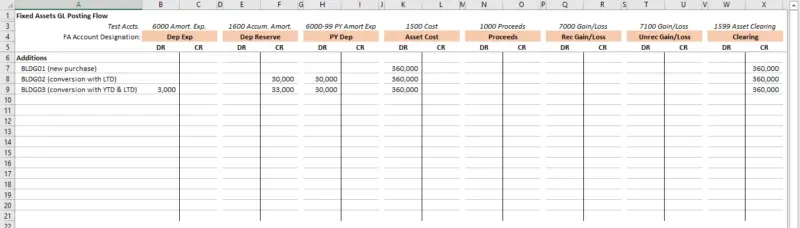

GL Posting Flow visualized

This is an Excel workbook I'm using to track through my scenarios. I will post something similar for each post, showing in T-account format what accounts are hit for each thing. Along the top are columns for each of the Fixed Asset "Account Group" setup account types and down the side I'll be listing the scenarios to visually show what the entry looks like.

That's it for this post, I hope someone finds it useful! Next up in the series will be a post about Amortization on these assets.