Back in September, I started a series and honestly figured I would not have taken this long to get to "part 2"! What I'm going to do is make this part of my #TipTuesday series and try to get through it a little bit faster!

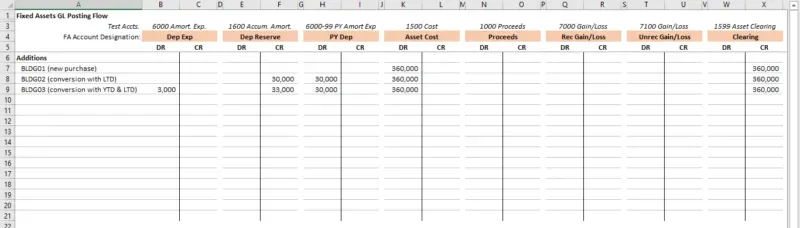

Today's post is about what happens during the Depreciation routine in Fixed Assets, from a GL posting flow perspective. The previous post in this series was GL posting flow around additions, in 3 specific areas:

- Additions during the current fiscal year (aka, normal operations once up and running with Fixed Assets).

- Additions that might occur from data conversion, that have LTD depreciation already but no current-year depreciation yet.

- Additions that might occur from data conversion, that have LTD depreciation and current year depreciation from a previous system.

Where I left off

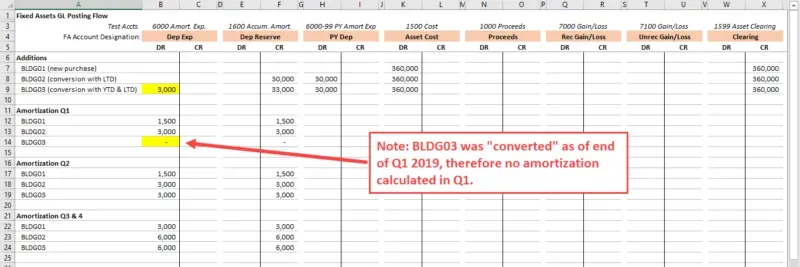

The ending point of my previous scenarios was this: 3 "building" assets were added to Dynamics GP, one for each scenario above. One asset, building 3, was converted from a hypothetical previous system where Q1 amortization had already been booked. The point of that was to show what occurs when converting assets with both YTD and LTD Depreciation values.

Scenario #1 - Q1 Depreciation

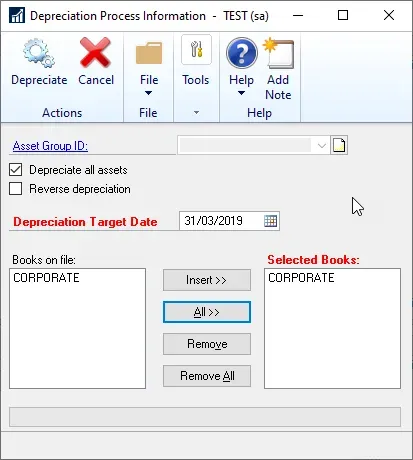

For this post, I ran through 3 depreciation routines, and the first one was to amortize for Q1 2019. I'm depreciating all assets and the target date is March 31, 2019.

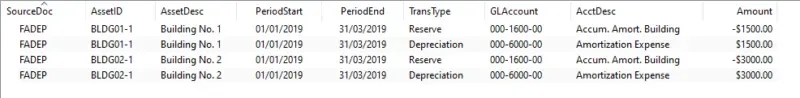

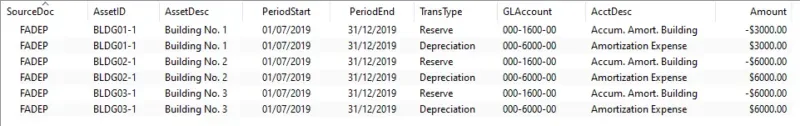

Scenario #1 - GL posting results

That depreciation routine resulted in the following journal entry. Building 1 was amortized for $1,500, Building 2 was amortized for $3,000 and Building 3 was not amortized at all.

- DR "Depreciation" Account (000-6000-00) for $4,500 combined

- CR "Reserve" Account (000-1600-00) for $4,500 combined

Why those values and what happened to Building 3? Here's the explanation:

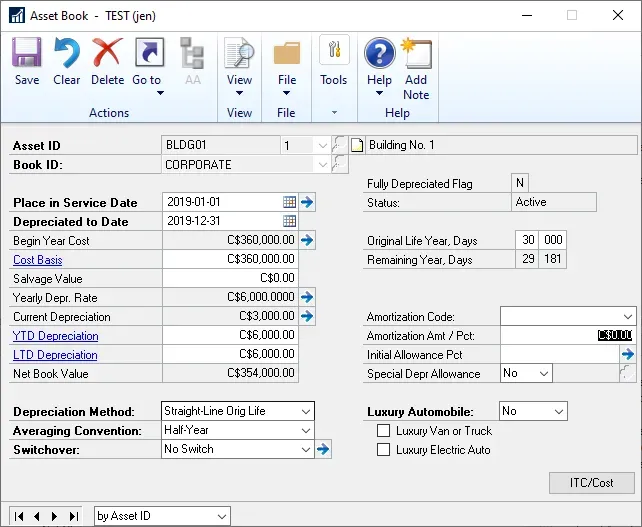

Building 1

This asset card is for a "new in 2019" building and was set up with an averaging convention of "Half-Year". The annual amortization will be $12,000 eventually ($360,000 cost, 30-year life straight line) but in the first year, the amortization is following a half-year rule. $6,000 in the first year = $1,500 per quarter.

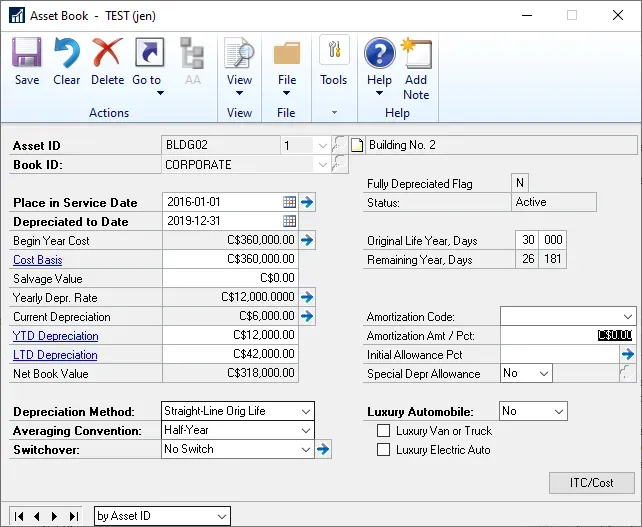

Building 2

This asset has the identical cost, but was purchased in a previous year and LTD depreciation is already factoring in the half-year rule from the year of purchase. Therefore, it is going to be amortized at $12,000 per year which is $3,000 per quarter.

Building 3

Building 3 was also purchased in a prior year, and the card was created with YTD depreciation up to March 31, 2019. So, for Q1 2019, it requires no additional depreciation and nothing was calculated.

Scenario #2 - Q2 Depreciation

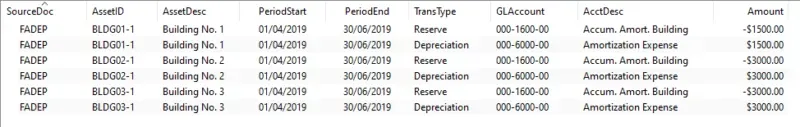

Next, I ran depreciation for Q2, i.e. up to June 30, 2019, for my hypothetical company. Building 1 was amortized for $1,500 again, Building 2 was amortized for $3,000 again and Building 3 was also amortized for $3,000.

Scenario #2 GL posting results

The journal entry looked like this, by asset and the overall entry was:

- DR "Depreciation" Account (000-6000-00) for $7,500 combined

- CR "Reserve" Account (000-1600-00) for $7,500 combined

Scenario #3 - Q3 & Q4 Depreciation

At this point, I didn't feel the need to continue working quarter by quarter as the pattern would be identical to Q2. I ran the depreciation routine through to Dec 31, 2019. The buildings were each amortized for 2 quarters' worth. In the real world, I wouldn't be posting lump sum amortization like this but for the sake of the example, running the routine 12 times to show monthly results would be a little tedious!

Scenario #3 GL Posting result

End Result

In the end, here is my spreadsheet of the posting results by account type. Depreciation is straightforward when it's not mixed in with additions or other types of changes in Fixed Assets.

Here are the Book windows for Buildings 1 and 2 (Building 3 is identical to Building 2 now - same acquisition date, value, depreciated to date etc.)

Next up I will be looking at retirements, with various scenarios, to illustrate how the posting flow changes depending on whether there are cash or non-cash proceeds, costs of sale and where they are in the YTD amortization routine etc.