Today's #TipTuesday is about the message the user may receive when back-dating a Fixed Asset retirement in Dynamics GP. I completed a project recently where the client was catching up on some IFRS asset derecognition that, in some cases, had occurred in prior years by the time we got around to doing the retirement in Dynamics GP. While this isn't an everyday occurrence, if someone else has to do this too, they also may get this odd message!

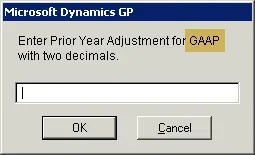

The message

Here's the message that pops up during the retirement processing. It says "Enter Prior Year Adjustment for with two decimals". When retiring multiple Fixed Asset books, this message will come up for each asset and book combination where the retirement date is prior to the current fiscal year. I've highlighted the Book name in the screenshot - one of mine is "GAAP".

What does it mean?

This KB article gives more information but long story short, Fixed Assets does not store the amount of depreciation taken in prior years (as strange as that sounds). So, when retiring an asset with a date before the current year, this pops up and the user can either click Cancel or enter the amount of depreciation that occurred from the date of retirement to the beginning of the current year.

An example

I am going to walk through an example of what the difference is in the journal entry between entering $0.00 or cancelling the above message box and entering an amount.

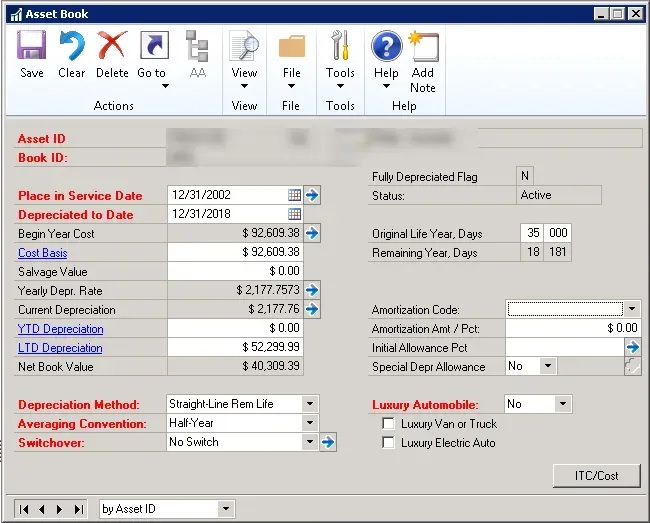

Book value before retirement

In my example, this is the Book card for a Fixed Asset I am about to retire. It's a 2002 asset that was retired up to the end of 2018. In my example, 2019 was the current fiscal year and we had not run 2019 depreciation. The "YTD Depreciation" is $0.00.

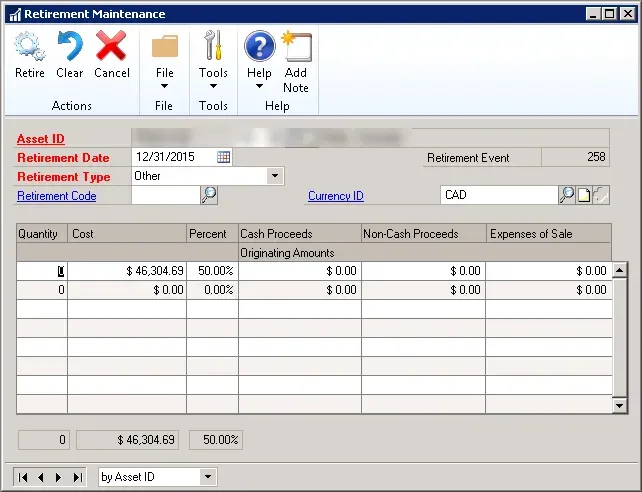

Retirement entry

In this retirement, it was back-dated to the end of 2015, 3 full years before the current year. Asset retirements can be done via Qty (proportionate to the Qty on the General card), via Cost amount or percentage. In this case, it was a 50% retirement. Once I entered 50%, the dollar amount populated (and the same would occur to Percent if I typed in Cost first).

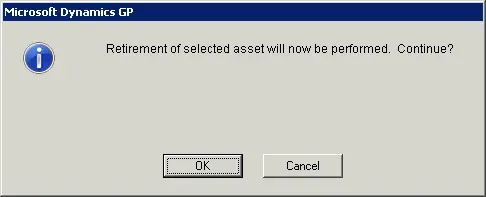

Once I clicked on Retire, a message came up where I needed to click OK or cancel to confirm my intent.

At this point, if the date was in the current fiscal year, I would get this message. In my test where I back-dated the message, I got the message asking for a depreciation amount and then I got this.

Retirement results

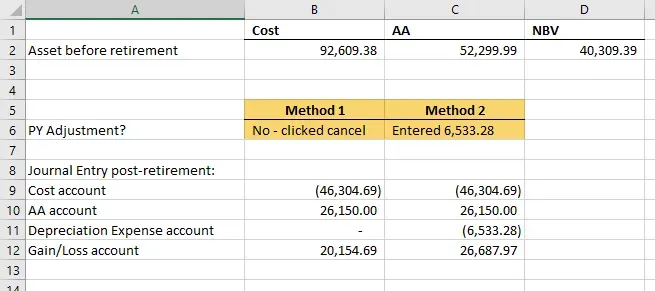

Here's a spreadsheet view of the two tests I performed.

- In the first test, I clicked cancel on the Prior Year Adjustment amount message. I entered no depreciation amount, and it did not reverse any depreciation since there was none "this year to date". The entire net book value was charged to the Gain/Loss account.

- In the second test, I calculated the amount of depreciation that would have occurred from the retirement date to the end of 2018 and entered that in the pop-up message box. That amount was backed out of depreciation and the subsequent gain/loss was increased (as the NBV of the asset went up, by backing out amortization).

End result

The result of this is when planning to retire assets with dates before the current fiscal year, do the math on the amount of depreciation that should be backed out. In the end, the difference is $0 on an overall P&L basis but the split between gain/loss and depreciation will matter in some organizations.