Today's #TipTuesday is the finale of my series on Fixed Asset transactions in Dynamics GP and what GL accounts get used where. In this post, I will walk through the rest of the catch-all set of scenarios around what kinds of asset changes impact the GL.

The previous posts so far are:

- Additions with & without YTD/LTD amortization

- Depreciation/Amortization

- Retirements in the 1st year of ownership

- Retirements after the 1st year of ownership

- Different retirement types & impact on Gain/Loss Account

- Retirements with proceeds and sale expenses

- Account changes & Mass Change impact on GL

Recap from last week

Last week's post covers some of the scenarios under which there is a GL impact on subsequent transactions. Namely:

- Changing the GL Accounts on the Accounts window

- Changing GL Accounts via Mass Change

- Changing Book via Mass Change

Change #4 - Cost or LTD/YTD Amort change on a Book card

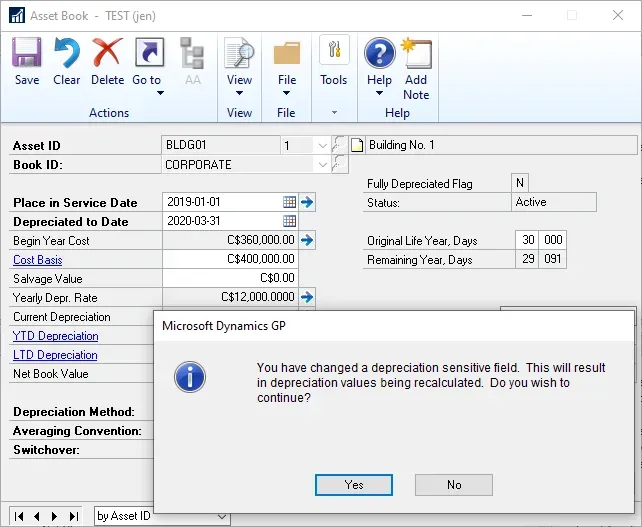

This kind of change is more obvious, but I'm going to cover it anyway! When making changes to the Book card, at a minimum the user is going to be prompted to reset or recalculate something (due to changing a depreciation-sensitive field). What I'm covering today is even more specific: changing the cost, up or down, or altering the YTD/LTD amortization amounts. The reasons to do this are for things like a revaluation of an asset or additional improvements to an asset such as adding value to an existing card instead of starting a new card.

In my example, I changed the Cost of Building 1's card from $360K to $400K. When I clicked Save, I was prompted with the "you have changed a depreciation sensitive field" warning. I chose Yes, and Recalculate in my example as I was assuming there is some improvement to the building causing an increase in cost base, on a go-forward basis.

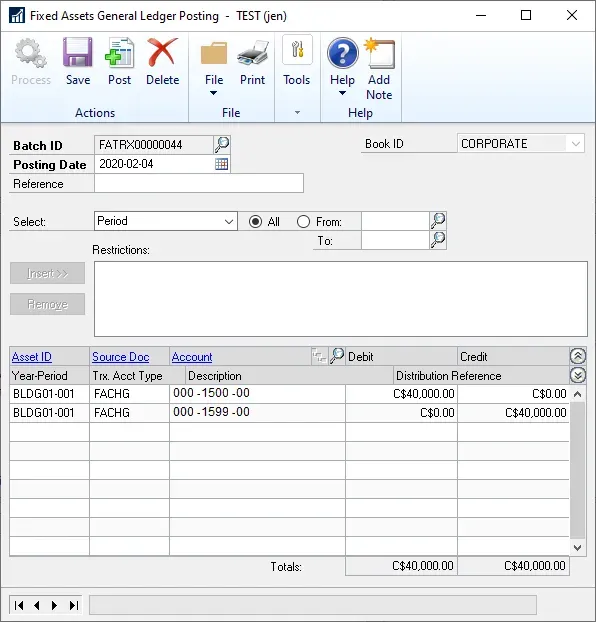

After making a change like this, when the users go to GL Posting, it will result in a journal entry such as this one with the financial impact of the changes made. If depreciation rates were changed, those would impact the next depreciation routine (unless the user chose "reset life" or "reset year").

Change #5 - Transfer or Mass Transfer with GL changes

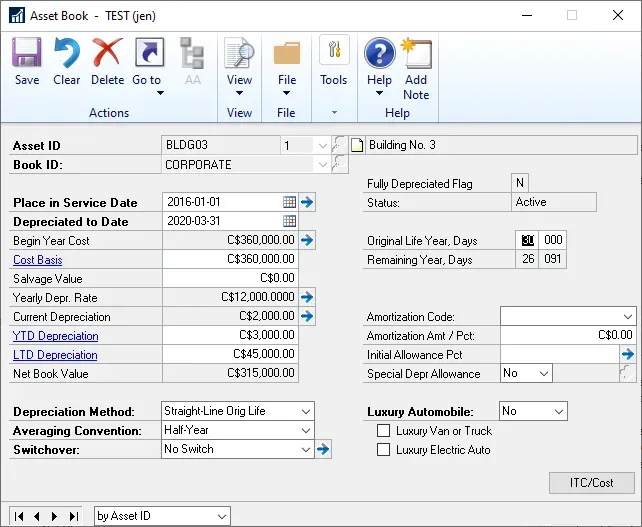

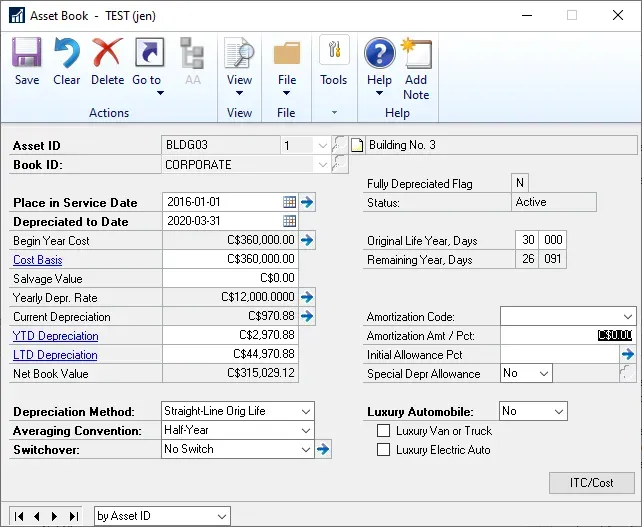

Not all transfers result in a GL impact but if doing a transfer with a change in GL Accounts, there will be a GL posting as a result. In my example, I did a full transfer of my Building 3 card from one set of accounts to another as of Mar 31st, 2020. (The accounts are hidden in a detail window)

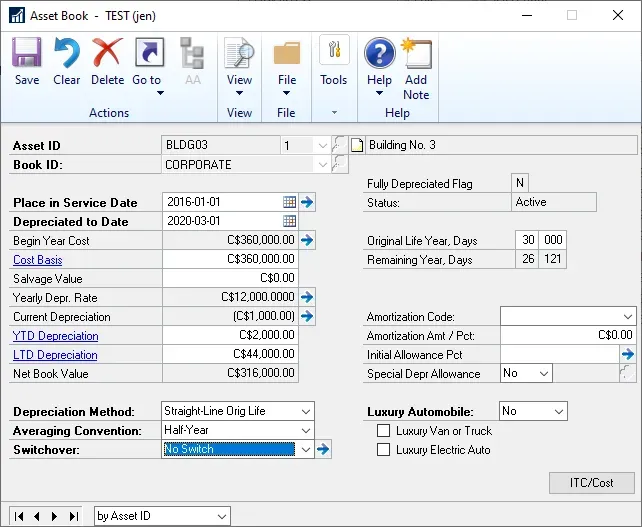

Here is the Book before the transfer.

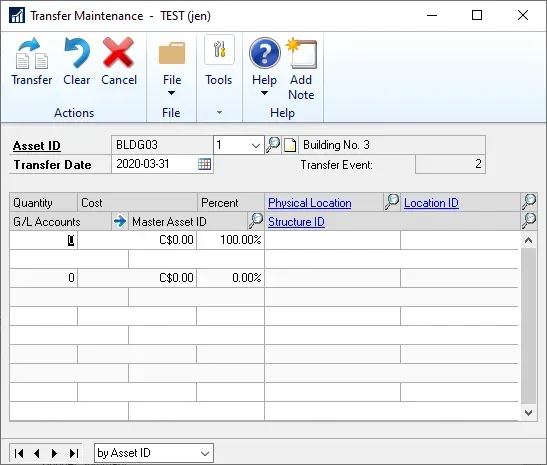

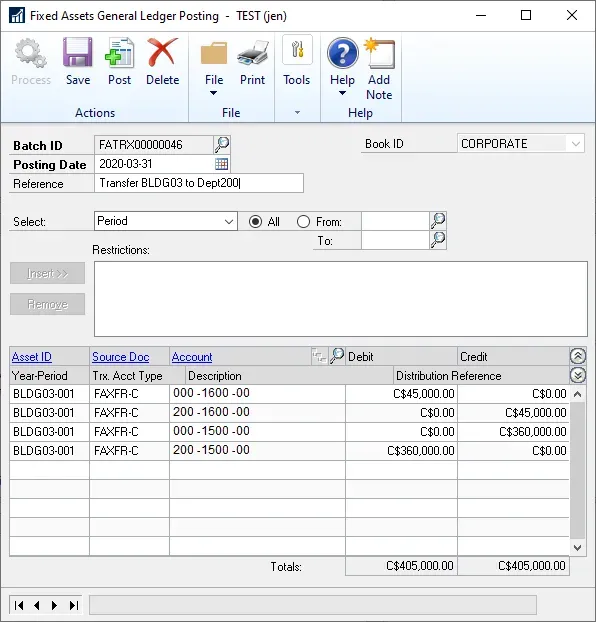

This is the transfer entry below. I had amortized this asset up to March 31st, so I will do the transfer on that date for the cleanest example. The change is hidden in the Accounts detail window, but what I did is transfer this to "Dept 200" accounts.

This is the GL Posting after the transfer. It moved both the Cost and the LTD amortization from old accounts to new accounts. What it does not do is move prior amortization expense to any new GL Accounts, because the effective date of my transfer is March 31st, hence it is assuming all prior activity stays where it was.

Change #5B - transfer with a date other than Depreciated To Date

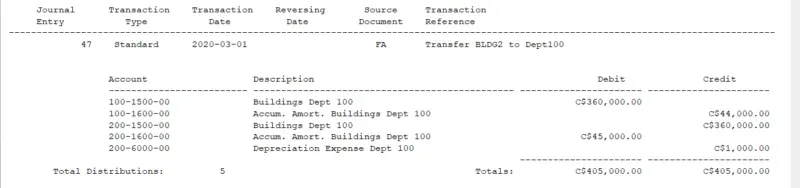

To follow that last thought through a little further, I did another transfer, to move this same asset back to Dept. 100 as of March 1st. Here's the GL posting:

Something didn't calculate properly here and it's a result of me getting lazy with my date selection. I chose March 1st instead of Feb 29th, which would be exactly 1 month short of where it was amortized up to. In theory, what it's doing above is moving cost to the right account and backing out amortization I've already booked between March 1 and 31st. That amount should not be $1,000, it should be close but a slightly odd amount, because it's less than 1 full month.

What happens on a transfer - rightly or wrongly - the transfer date becomes the Depreciated To Date on the Book. Here is the book after this transfer was done. Notice the Depreciated to Date is now March 1st?

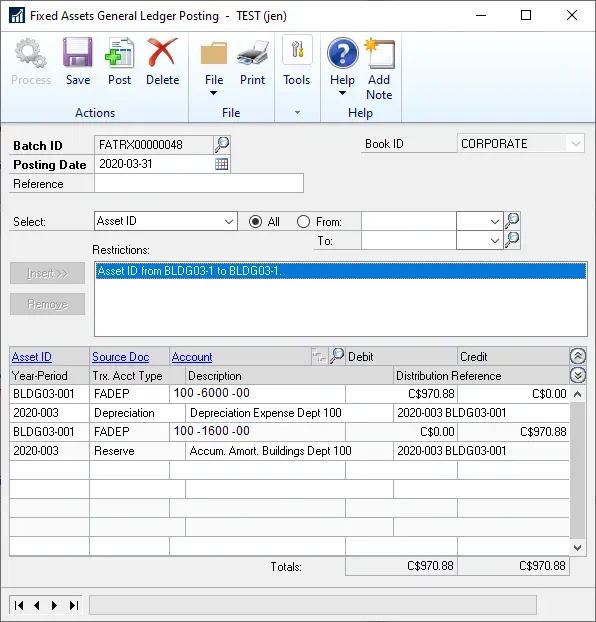

Since I had previously amortized this asset up to March 31st, I re-ran the Depreciation routine but it didn't recalculate the book the way it should have up to this point. Here is that GL posting.

… and here is the new book window as of March 31st's amortization. The result should be the same values here are were in my original post but they are not.

I'm not sure what to think about this other than if I am going to do any transfers that have GL impacts, I am going to be very careful to take before and after screenshots or data dumps of the book values to ensure the values return to where they should when it's done. In this case, it's off by $29, not a super big deal but it shouldn't be off at all.

Change #6 - Deleting a Book card or deleting an Asset

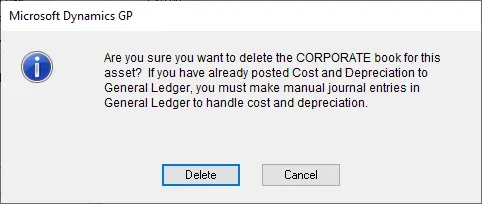

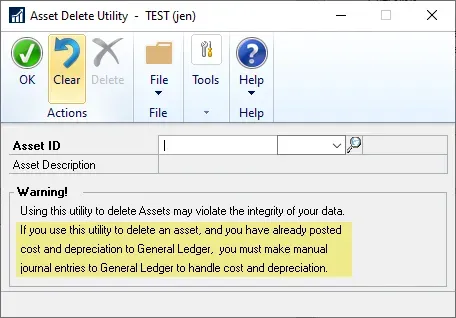

Last scenario of the series! If deleting the Book card of an asset, or deleting an asset entirely (under Routines), the user will be prompted with an explicit warning that there will be no GL entry created.

First, this is the warning if the user deletes the Book card of an asset.

Similarly, on the Asset Delete Utility window, the same message is noted on the window to warn the user.

When deleting a Book card and re-creating the book again, what the user will get is a GL posting for "adding an asset" since adding values back to the Book window is essentially adding an asset into the system. Deleting the Book card will not generate a journal entry so beware of this when fixing assets that have already synced the addition to the GL.

Summary

With this post, I've concluded the series on Fixed Asset posting flows. I believe I have covered most of the common scenarios clients run into to identify which GL accounts get used where in Fixed Assets. While I didn't cover all of the nuances of every type of depreciation setting, for instance, the entries should pretty much be consistent throughout even where the calculations differ.

I hope someone found this helpful in understanding the Fixed Assets module better when it comes to the GL side of things!