Greetings everyone! Great news for those using Canadian Payroll in Dynamics GP, the tax update was released earlier than expected. Let the installs begin!

There are a lot of changes this year, so please make sure to follow the Microsoft Support pages for the latest information and updates. The best page to watch for updates is the one below. There are a few blogs and pages that contain similar information but this one typically is updated first.

NOTE: I am only documenting the Canadian Payroll-specific pieces in this post, there are several new features in the 18.6 release of Dynamics GP overall that are part of this and were shared on the "Feature of the Day" Microsoft blogs.

Key information

This installation includes the October 2023 release (& the November US Payroll year-end release), the Dynamics GP build will now be 18.6.1695. Do not install the updates separately, each update includes all prior releases in it.

- The Canadian Payroll version will be 18.6.1724 when the installation is complete.

- The KB of the ENU (English) installation is KB4602612. The link is on the page URL identified above.

Major changes in this release

Table changes

This Microsoft blog has a list of the tables that have changed to add new columns, some relating to the overall 18.6 release in October, and some specifically in this Canadian Payroll Year-End update.

CPP and QPP changes

There is a new "second CPP" (Canada Pension Plan) contribution and a similar second QPP (Quebec Pension Plan) contribution for Quebec that was added to this update. It is a change for the 2024 payrolls.

Some background about this is in this webinar recording (CPP specific): https://www.canada.ca/en/revenue-agency/news/cra-multimedia-library/businesses-video-gallery/canada-pension-plan-enhancement-second-cpp-contribution.html

ROE changes

There is a change in this release around ROEs (Records of Employment). Service Canada has added "M" as a potential starting character for an ROE serial number. Before this release, users would get an error trying to create an "M" ROE and have to edit it after uploading it, now this is resolved.

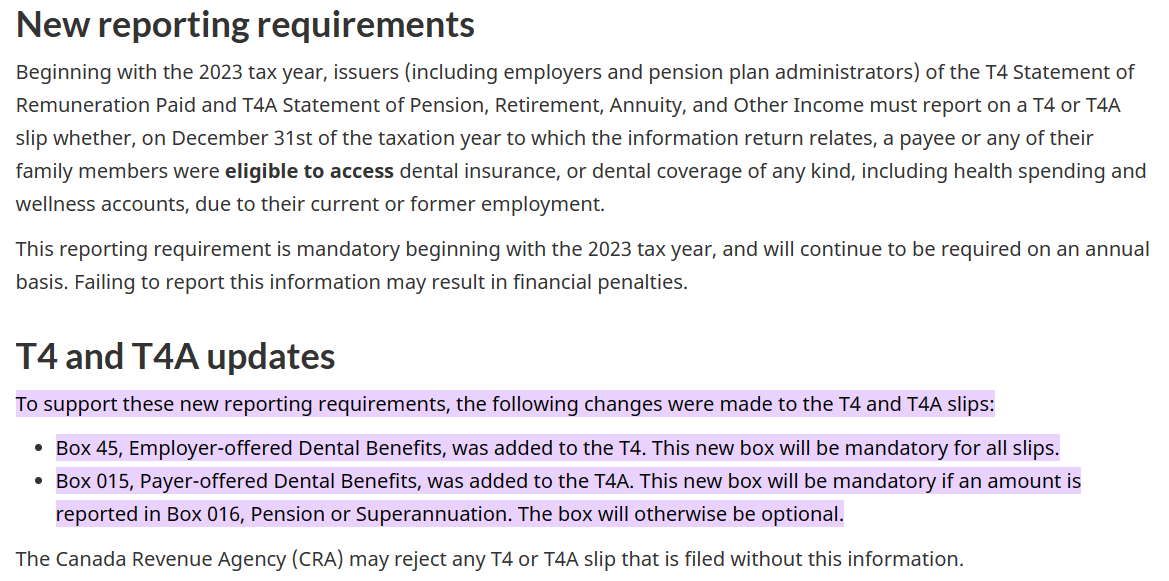

T4 changes

The last major new item in this year's release is for T4 changes relating to the Federal Dental Benefit. Specifically, employers are required to populate a new Box 45 on T4 forms and Box 015 on T4A forms for 2023 onwards. The information identifies if the employer offers dental benefits to the employee, which will tie into whether they qualify for the new federal dental benefits.

The link is here with a screenshot of the key part as it relates to this blog article. https://www.canada.ca/en/revenue-agency/news/newsroom/tax-tips/tax-tips-2023/employers-pension-plan-administrators-changes-coming-t4-t4a-reporting.html

Other changes

The general changes in this year's tax update include, in addition to the above specific items, these tax-related changes:

- Federal BPA (Basic Personal Amount) has changed.

- Tax changes for Manitoba, Prince Edward Island, and Yukon.

- General changes for all provinces (index factors etc.)

Final update!

When I moved my blog over to this new site, I removed all the previous blog articles about tax updates as they were all out of date. This article will be removed once next year's update is released in 2024!