This post is specific to Microsoft Dynamics GP in case someone is reading this post after searching for more general information on this topic.

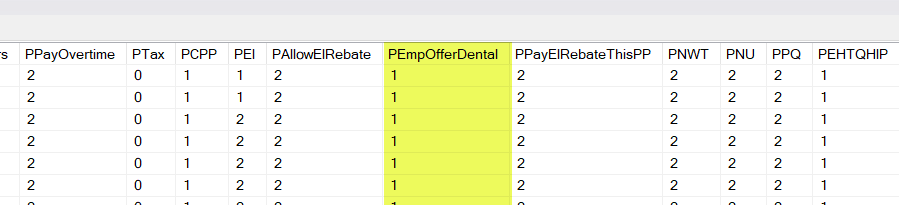

After the Dynamics GP Year-End 2023 update is installed, some of the tables include new columns for the Employer-offered Dental Benefit tracking now required on T4 and T4A forms. The default value for all employees is a value of 1 in column "PEmpOfferDental" which corresponds to "No dental insurance of coverage of any kind".

What are the values to choose from?

This screenshot from the "How to fill out a T4 slip" page on Canada.ca shows the valid values for the employer-offered dental care boxes on the T4 and T4A forms. The specific requirement noted is based on the employee's benefit on December 31st of the tax year. This box is mandatory for 2023 onwards.

| Value | Description |

|---|---|

| 1 | No dental insurance or coverage of any kind |

| 2 | Payee |

| 3 | Payee, spouse and dependent children |

| 4 | Payee and their spouse |

| 5 | Payee and their dependent children |

How to set value in Dynamics GP

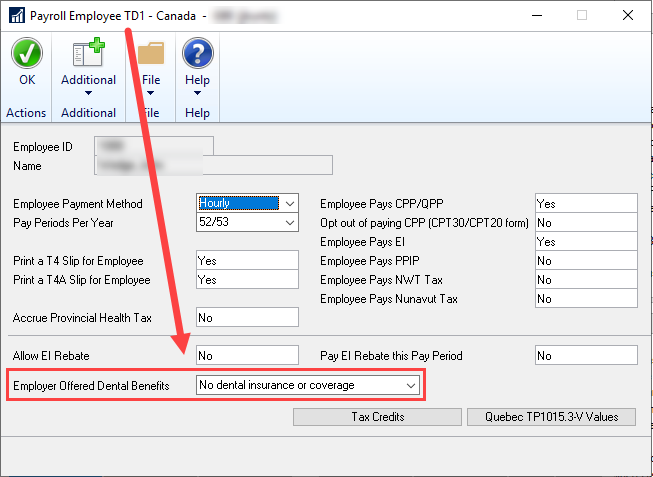

The field is called "Employer Offered Dental Benefits" and it is in the TD1 window for the employee (HR & Payroll > Cards > Payroll > Employee > TD1 Values).

How to set the value via SQL Script

This could get slightly more complicated as the script below will update all employees with the same value.

It is possible to update some employees instead of all with a WHERE clause but the exact script will be dependent on the CPY configuration in the applicable companies. Below I've pencilled in the WHERE clause but have not provided a value for it as I can't do that generically. These scripts are provided as an example, use them at your own risk. For those not familiar enough with SQL to edit or execute them, please reach out to the GP partner or consultant for assistance.

/* USE THESE SCRIPTS AT YOUR OWN RISK */

-- There are 4 scripts here, representing the 4 tables with this field.

-- Not all tables need updating, it will depend on when you ran the Year-End Reset

-- ALL examples below would set the value to 1 which is already the default setting.

-- Change the "1" in the SET part of the query to whatever numeric value is appropriate.

-- Run the script against each company with CPY configured.

-- If running the script before YE Reset, this should be all you need to do:

-- CPY Employee master table

UPDATE CPY10100

SET PEmpOfferDental = 1

-- <optional> WHERE ________

-- If running the script after YE Reset, you may need to update all 3 tables:

-- CPY Last Year Employee Master table (if YE Reset was run before updating this)

UPDATE CPY50100

SET PEmpOfferDental = 1

WHERE PYear = 2023

-- If the T4 records need to be updated

UPDATE CPY40101

SET PEmpOfferDental = 1

-- <optional> WHERE ________

-- If the T4A records need to be updated

UPDATE CPY40102

SET PEmpOfferDental = 1

-- <optional> WHERE ________