Today’s #TipTuesday post comes from a GPUG forum question that someone posted recently, answered by Victoria Yudin. It’s a good example of what I like to post as “tips” because it’s pretty small but useful to know.

The question essentially was about getting an error about an inactive Retained Earnings account when trying to run the year-end close routine in the General Ledger in Dynamics GP, and the poster questioning if it’s because “Close to Divisional Account Segments” was marked.

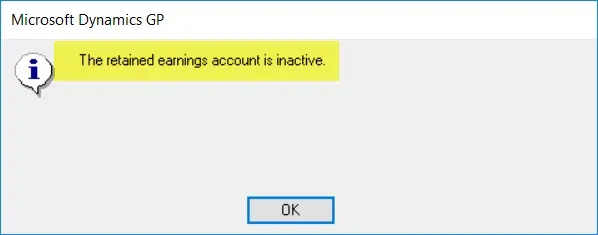

The Error

This is the type of error the original poster got:

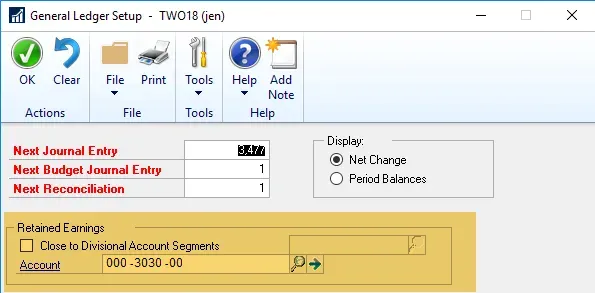

General Ledger Setup

Here are the options in the General Ledger Setup window, per company, that affect the year-end close routine.

For the sake of this post, I’ve clipped off the bottom of the window to show only the relevant section I’m discussing.

The poster on the question above asked, essentially, does it matter if the “Close to Divisional Account Segments” is ticked or not? Victoria Yudin correctly answered that it is very important and should only be marked by a user who is sure what it does. The impacts of marking this or not marking it are relatively easily fixed via a journal entry if need be though.

In my experience, for most companies, this is unchecked, based on what I’ve seen over the years. The companies that do use this feature are ones where they have a segment in their GL identifying business units that have their own Balance Sheets within one company in Dynamics GP. The only reason to use this is if I need to report on different Balance Sheets really, as it wouldn’t impact a P&L at all.

How it works

If it is marked, the Segment lookup to the right of that tickbox becomes enabled and the user needs to select a segment of the General Ledger Account Format as representing the “division”. What this means is at year-end, the year-end close routine will (essentially) summarize my P&L activity by that segment to get a total net profit/loss for each unique value in that segment and then it will look to post that to a Retained Earnings account for each unique value, using the rest of the default Retained Earnings account specified in the General Ledger Setup window to determine what the full GL account looks like.

That was a mouthful and not the simplest wording to wrap one’s head around. Let me break it down a little further with an example.

Let’s say I use Segment 1 to identify my business units, whatever I may call it, within one Dynamics GP company. Throughout the year, I post my transactions to the various P&L accounts and let’s say at year-end, I have 3 distinct lines of business – business units 100, 200 and 300. Let’s also say I want those closed to 3 separate Retained Earnings accounts during year-end close and I would rather have the system do this for me vs. manually doing a post-year-end-close journal entry. Perfect: that’s exactly what this feature is meant to do!

In General Ledger Setup (pictured above), I would tick the Close to Divisional Account Segments box and select Segment 1 from the segment list beside it. For the sake of this example, let’s assume my default account number for Retained Earnings is what is pictured, 000-3030-00. In this field, I may not have a 000- account for Retained Earnings so I should put in here ONE of my legitimate Retained Earnings accounts.

The year-end close routine will be looking at that and using Segment 1 as a “mask” of sorts, to find valid Retained Earnings Accounts to post to. In my example, even with the 000-3030-00 account in the setup window, my P&L would close out to the following 3 accounts. Nothing would post to the 000- account if there was no activity, despite it being listed in the window as the Retained Earnings account.

- 100-3030-00

- 200-3030-00

- 300-3030-00

In this example, NONE of those GL accounts can be inactive at the time I run the year-end close routine.

Now: what I have not tested is a situation where the default account in the General Ledger Setup window is inactive but not required for the year-end close routine. If I have listed 000-3030-00 in the window and it’s not needed, it likely could be inactive but I wouldn’t be surprised if it too should be active just because it’s listed there. It would be interesting to test this.

Gotchas to watch for

- In my simple example, there was NOTHING posted to a P&L account with anything other than a 100-, 200- or 300- account number. If I had activity posting to, say, 400- accounts and then during the year those business units were re-allocated to other business units so they have a zero net income at year-end, the year-end close routine would still expect to have an active 400- Retained Earnings account. If the net income is zero, nothing would post to it but it needs to be a valid account + active. If there weren’t any transactions at all in the fiscal year being closed then I no longer would need to worry about it.

- If I were to describe an extended example that customers have asked me about, it’s one where they may have 3 business units as I describe but they have differentiation within the segment that matters to them in the P&L. Example, they have P&L accounts with 100, 110, 120, 200, 210, 220, 300, 310, 320 etc. but when it comes time to close this to Retained Earnings, they want all of that closed into the “parent” business unit, 100, 200 or 300 respectively. That is not how this feature works. GP would want a valid 100, 110, 120 etc. Retained Earnings account to close to.

- The last gotcha is from previous customers occasionally asking if the Retained Earnings accounts can be different in their pattern. I used the example of XXX-3030-00. The rest of the account numbers must be identical for this feature to work, as it’s only “masking” or swapping the first segment for the values in the P&L accounts. However, I do have a suggestion for this if they do have different Retained Earnings accounts per “division”: look at a Fixed Allocation account. As long as “an account number” exists for what GP is looking for, in the pattern of XXX-3030-00 from my example above, it should work. I say “should” because I have not tested this recently but I believe a customer of mine did this and it was fine.

For example: I would set up a Fixed Allocation account for 100% of the distribution to go from the Retained Earnings account that GP is looking for to the R/E account I’ve set up in the chart of accounts. It might look like this:

- 100-3030-00 >> 100% goes to 000-3031-00

- 200-3030-00 >> 100% goes to 000-3032-00

- 300-3030-00 >> 100% goes to 000-3033-00

This is a little bit of a silly example but I have seen customers with Retained Earnings accounts by “division” that don’t follow the same numeric pattern.

Hopefully, this tip helps someone understand this feature better and if it could be useful to them!