A client of mine had a great question for me last week on the ROE (Record of Employment) form that I couldn't answer off the top of my head. I took the opportunity to research and test to answer the question and figured it is not an uncommon question, so I may as well share the info.

Before I begin, I am not a payroll guru, I simply understand how the payroll modules work in Dynamics GP. This is not meant to be a "how to complete an ROE" form article. I worked for a few years with an actual payroll guru, who in her own words, could make Canadian Payroll sing! (RW, you know who you are!)

The Question

Why are the insurable earnings listed in the pay period boxes (section 15C) not the same as the Total Insurable Earnings in box 15C? And why does 15C not tie into the T4 insurable earnings on the employee card?

The Short Answer

For the most part, the short answer is there are timing differences (ROEs usually will span more than one calendar year and T4s are calendar year only). The interesting thing which I didn't know is the specific rules around how 15A, 15B and 15C sections are calculated.

Quick ROE rules

Full rules are available here in this guide. My examples are based on a weekly pay period, which was this particular client's pay cycle.

Box 15A Total Insurable Hours

- This is the number of insurable hours for the number of consecutive pay periods, based on the pay period length. My client's payroll is weekly, so they need insurable hours for the last 53 pay periods. The PDF guide above has a table to help identify this.

Box 15B Total Insurable Earnings

- This is the total insurable earnings for the number of consecutive pay periods, based on the pay period length BUT a different table applies vs. the table for 15A. For a weekly payroll, the correct number of consecutive pay periods is 27.

Box 15C Insurable Earnings by Pay Periods

- This is the insurable earnings by pay periods and requires either 27 or 53 periods depending on whether paper ROEs or electronic are being filed. The number of boxes filled here has nothing to do with the # of periods tables above.

- If an employee was absent for a pay period and had no insurable earnings, the box is $0.00.

- The number of pay period boxes completed, to the max number above, is dictated by the period of employment - starting with the pay period that box 11 (Last Day for Which Paid) falls in, working backwards through to the pay period that box 10 (First Day Worked) fell in.

The Long Answer with an example

The example the client provided me with is for an employee on a weekly payroll who started in early December 2010 and finished their employment in July 2011.

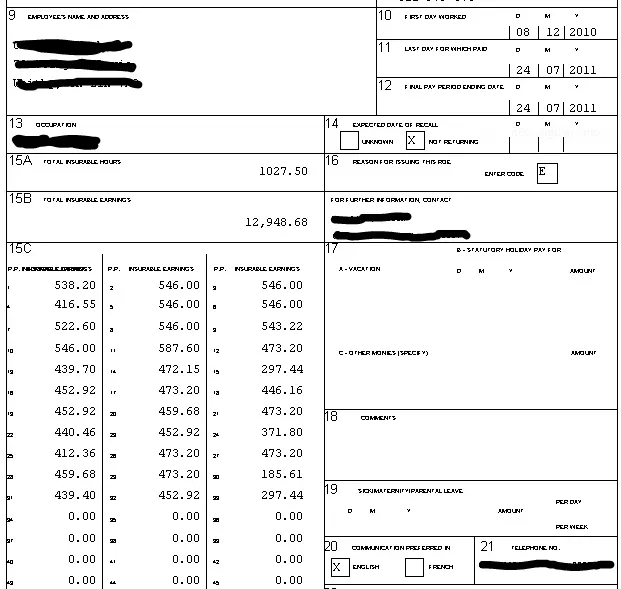

The ROE (partially shown):

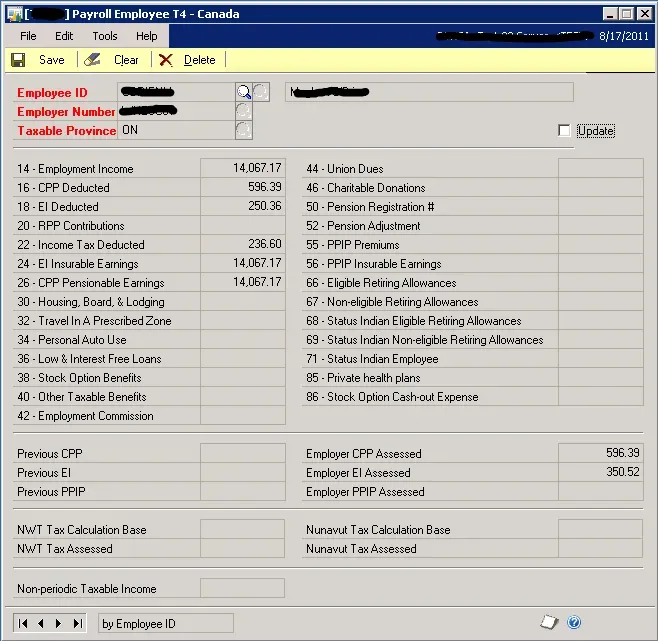

The T4 window on the Canadian Payroll employee card (year-to-date T4 values, not the actual T4 creation window).

On the ROE, 15A shows total insurable hours of 1027.50 which is EI insurable hours from, in this case, the employee's start date of Dec 8, 2010, to the last date worked of July 24, 2011. Had they been working for a longer period, it would be the last 53 weeks of EI insurable hours.

Field 15B shows total insurable dollars of $12,948.68 yet box 24 on the T4 shows EI insurable earnings of $14,067.17 - why? Well, further to my explanation above, the T4 window is showing year to date (as in CALENDAR year to date - the basis for T4 records) so it is covering pay dates January 1, 2011 to July 24, 2011 (employee's end date). Box 15B only shows the last 27 pay periods for a weekly payroll, which means it is only showing earnings from approximately mid-January 2011, not all 2011 pay dates.

Field 15C is the list of the last 53 pay periods, so the sum of those fields also does not match 15B, by design. 15C is in reverse order so to tie the numbers back together, add the first 27 pay periods to get to the number in box 15B and add in the remaining 2011 pay periods to match the T4 window value.

In Summary

Only in select cases will the T4 window and the ROE ever "align" - it would have to be for employees with short employment durations, like summer students perhaps, and within the same calendar year. This client does not have a lot of turnover and most of their ROEs are for summer students so in the past, nearly every ROE matched to the T4 window. They assumed it would always match and started "reconciling" using that window's data, until this particular time when they didn't align (and for good reason).

Hopefully, that helps clear up a bit of confusion on the ROE forms for someone out there!