Today’s #TipTuesday is too late for 2018 filings but hopefully, those this applies to will file it away for next year. The post is a result of a question from a consultant who works for one of the Dynamics GP VARs in the Toronto area, whose client asked how to get 1 XML T4 file for multiple employers.

TL;DR version: it does that out of the box although the UI doesn’t make it seem like it would! Since some people may stumble across this post and use other ERP systems, this post is specific to Dynamics GP and the Canadian Payroll module.

Business Numbers

It’s not uncommon for a business to have multiple payroll accounts with the Canada Revenue Agency, under the same business number. For those who are unclear about the specific terminology, here’s a quick run-down of what the full number looks like before I get into the specifics of this post:

- Example: 12345 6789 RP 0001

- Business Number = the first 9 digits

- Program ID = the alpha 2-character code

- RC = Income Tax

- RP = Payroll

- RT = HST

- RM = Import/Export

- RZ = Information Returns (T5 filing etc.)

- Account Number = remaining 4 digits but at that point, it’s specific to the Program. For example, a company (like the one I work for) may have multiple payroll accounts (aka multiple employers) due to rate differences in EI and things like that. Their “payroll account” would be RP0001 for the first account and RP0002 for the second (& so on, if it’s even possible to have more than 2 accounts).

Multiple Employers & Single XML file

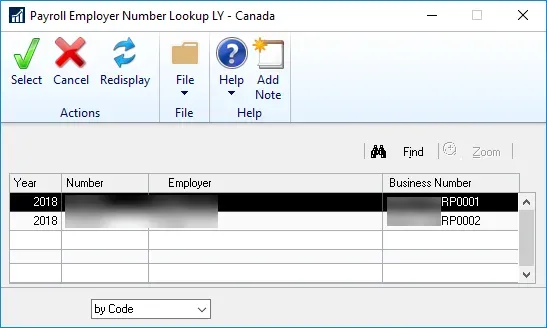

Here’s where screenshots will help explain things better. I’m using my company as an example since I don’t have enough data to demonstrate this in my test data. Within our primary company (as in the “Dynamics GP” company database), we have 2 employers.

Employer Setup

I won’t go into actual Employer Setup for this post as it’s irrelevant to the point of this article. Suffice it to say we have 2 employers set up in 1 GP company database. The employers have slightly different setups due to EI rate differences but otherwise, the primary difference is the Business Number, which in the case of Dynamics GP includes the Program and Account number reference.

Employees are assigned to either Employer 1 or Employer 2.

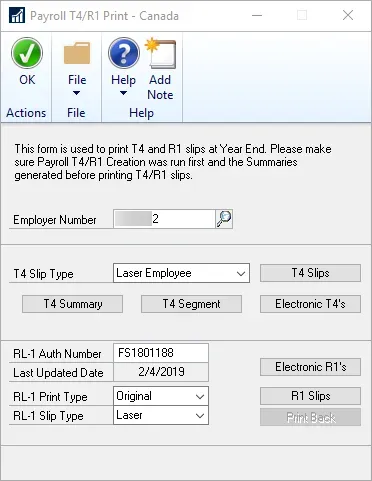

T4/R1 Print window

At year-end, after the T4s and RL-1s have been edited and prepared, the last step other than distributing the forms to employees is to submit an XML file to the Canada Revenue Agency website. The “Payroll T4/R1 Print – Canada” window is where that is done.

Now, I can’t speak for printing as I didn’t test that, but for the Electronic T4’s part of the process, the window makes it appear as if payroll may need to do 1 employer at a time; however, the employers are generated into one file, one return per employer. I should be clear at this point that I am merely assuming the R1 works the same way. We don’t operate in Quebec and I’ve never had a Quebec payroll client to test this functionality with.

In the window above, I chose Employer 2 (for no particular reason other than to prove the example). Next, I clicked on Electronic T4s.

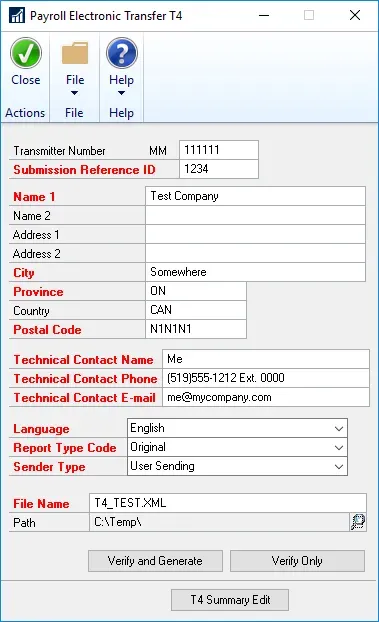

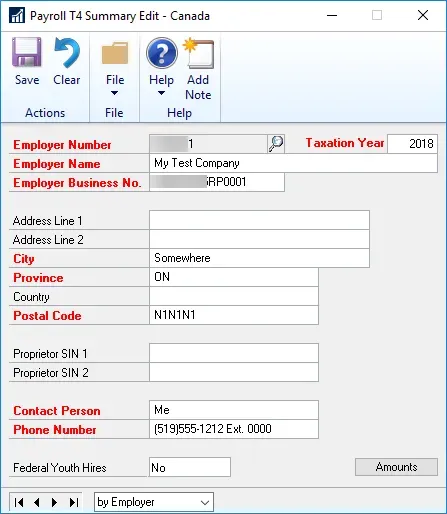

I filled out the information (fake data of course!) and then went into the T4 Summary Edit button to record the information for each employer. Here’s an example of that:

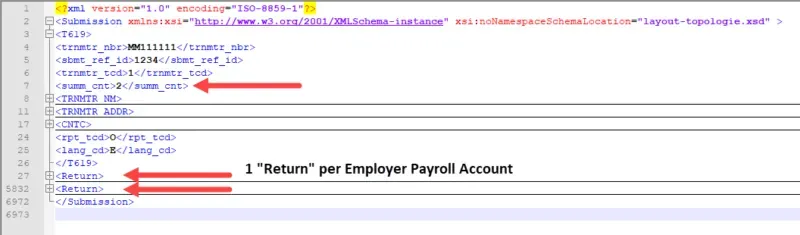

Just for kicks, I even entered a different company name for Employer 1 and 2 to see what would happen in the file. It uses Employer 1’s info in the T619 section of the XML file and then whatever was typed in for the T4 Summary section of each return generated.

Verify & Generate

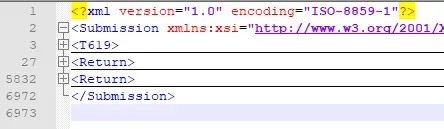

Back on the Electronic T4 window, I clicked on Verify and Generate to create the actual XML File in my temp directory. Here’s the result:

My XML file contains 1 T619 section (correct: one per submission), and 2 Return sections (correct: one per employer account) and all looks good. The T619 section shows a “summary count” of 2 returns, which is also correct.

Summary

So, to recap, even though in the T4/R1 Print window I was seemingly selecting one of the employers, the XML file generated includes both employers. I would rather see those windows separated if a user had to print the forms one employer at a time so that it is more obvious to the payroll admins, but once this is known, it likely won’t be forgotten the next year.