This was a blog I was planning on writing earlier this year but the topic had slipped my mind. Earlier today I was browsing the forums at GPUG and one thread reminded me of this topic so I figured today's a good time to get this post written while it's fresh in my mind.

The Myth

The myth I've heard more than a few times now is some variation of "All accounts must be active during year-end close." As the story goes, if there are inactive accounts that have activity in a year (P&L accounts for example), the myth is in Dynamics GP the GL accounts need to be re-activated before year-end close.

The Reality

The only GL accounts that need to be active for the Year End Close routine to work are the Retained Earnings account(s) specified in the General Ledger Setup (including the divisional accounts if closing by divisions). I've tested this on GP 2016 for this post but I also tested this on GP 2013 on a client's test company data too. Another user commented that they know this is fine on GP 2010 as well. It could very well be that at some point, in some version of Dynamics GP, accounts had to be active for year-end close. If that is the case, I have honestly never run into that issue with any client I've worked with before which is why I wanted to dispel the myth.

Some Proof

It's a good thing Fabrikam Ltd. has several open years by default! This allows us to easily test a year-end close with sample data, without a lot of effort. In my case, on GP 2016, Fiscal 2014 is open (and everything after that) so that's what I worked with.

Test 1 - Inactivate every account, then try the Year-End Close

I went to the extreme to keep it simple. I went into Mass Modify and inactivated every GL account!

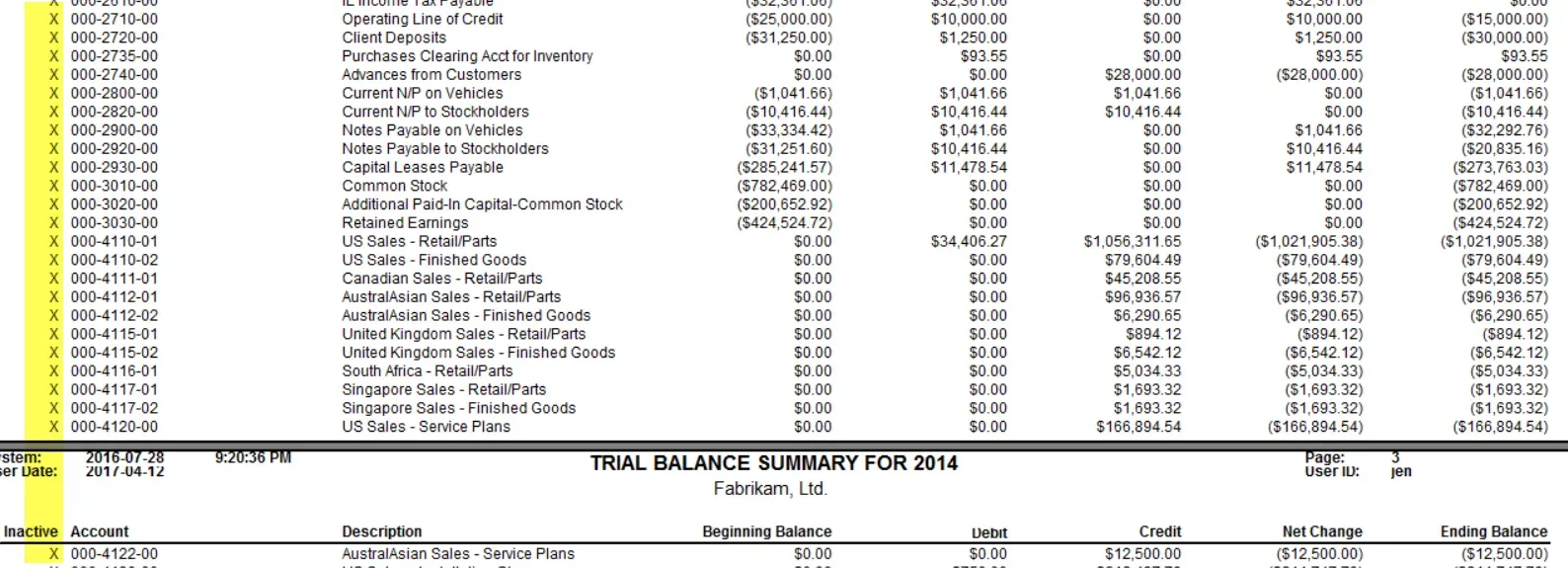

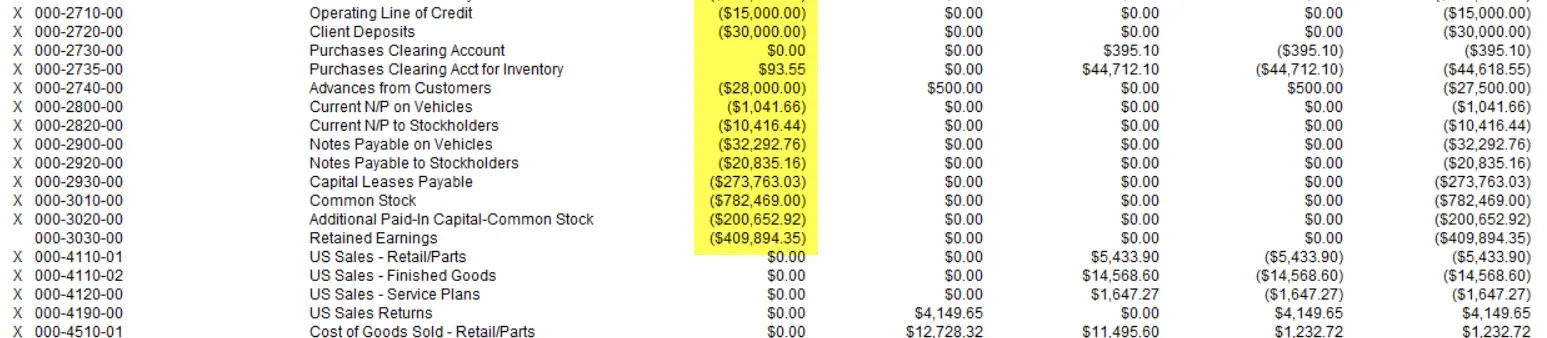

Here's a snapshot of part of the Trial Balance Summary report that shows some balance sheet accounts, including Retained Earnings, and some profit and loss accounts - all with balances, all inactive.

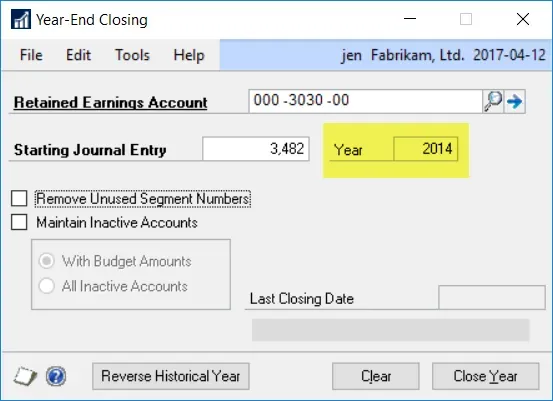

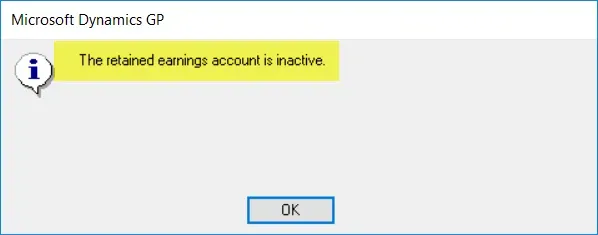

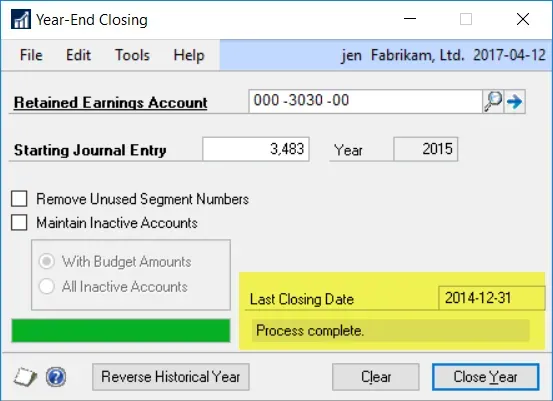

Then I went into the Year End Close window and did nothing but click the Close Year button. Here's the window, followed by the error message warning me that the Retained Earnings account is inactive. Notice that has no "continue" option - that account needs to be active to continue.

Test 2 - Re-activate Retained Earnings, and try Year End Close again

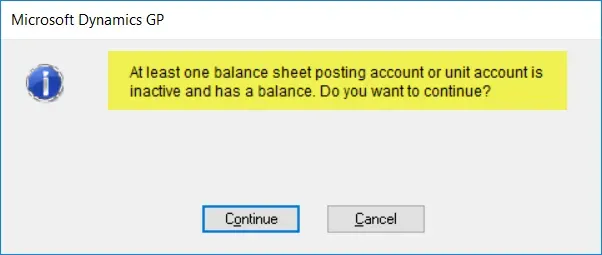

This time, I received a different message, but it was purely a warning. Click Continue to proceed, as this is just a warning.

Voilà, success!

Here is one last pic which is the 2015 TB summary for the same range of accounts. The opening balances are all updated as expected for the amounts that were the ending balances of the 2014 year, even though the accounts are inactive.

Hopefully that dispels this myth and has the added benefit of making year-end close go a little faster, now that there is no need to activate accounts, and remember to inactivate them again afterwards!